The crypto market finds itself in the grips of a concerning predicament as a bearish technical formation tightens its grip, exerting downward pressure on the total market capitalization. Bitcoin’s recent 2% drop, plunging to $26,457, accompanied by BNB’s 1.7% slide to $304 and XRP’s 2.5% dip to $0.45, have spurred a noteworthy 1.3% correction between May 18 and May 25.

Since its inception in April, the ominous descending wedge formation has cast a gloomy shadow, signaling a potential breakout hovering around the $1 trillion mark by late July. However, the prevailing bearish structure, responsible for driving the total capitalization down to $1.11 trillion on May 25, implies that any upward movement will require an arduous battle.

Inflationary concerns continue to plague investors’ minds, leading to heightened anticipation of further interest rate hikes by the United States Federal Reserve. The latest personal consumption expenditure indicator in the country has delivered a staggering blow, showing a significant 5% surge, surpassing the targeted 2% inflation threshold.

Adding to the growing unease, Germany’s statistics office announced a disappointing revision, revealing a downward adjustment in the country’s gross domestic product for the first quarter of 2023 from 0% to -0.3%, marking a consecutive decline. Moreover, the impending U.S. debt ceiling standoff and the dwindling cash reserves of the U.S. Treasury only add to the mounting uncertainties.

Regulatory risks loom large on the horizon, as governments worldwide tighten their grip on crypto assets. Notably, the European Systemic Risk Board (ESRB), an oversight body within the European Central Bank, has raised concerns about bank runs associated with stablecoins. The ESRB’s apprehension centers around the lack of transparency, using Tether USDT $1.00 as a striking example.

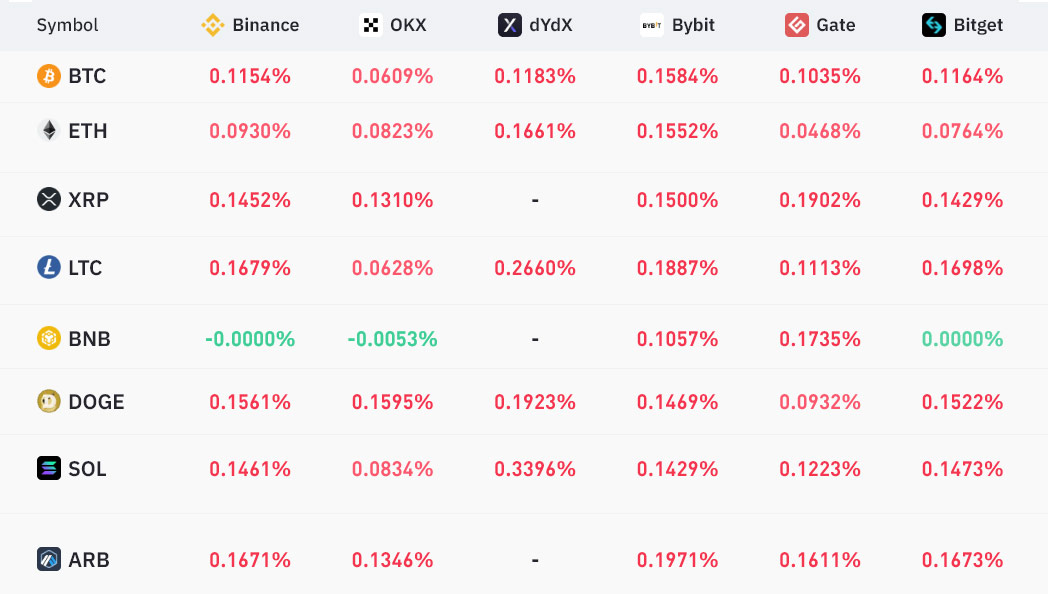

Delving into the realm of perpetual contracts, or inverse swaps, reveals a complex landscape with embedded rates that are typically charged every eight hours.

Analyzing the seven-day funding rate for BTC and Ether ETH $1,805 perpetual futures contracts, a neutral outlook emerges, indicating a delicate balance between leveraged longs (buyers) and shorts (sellers).

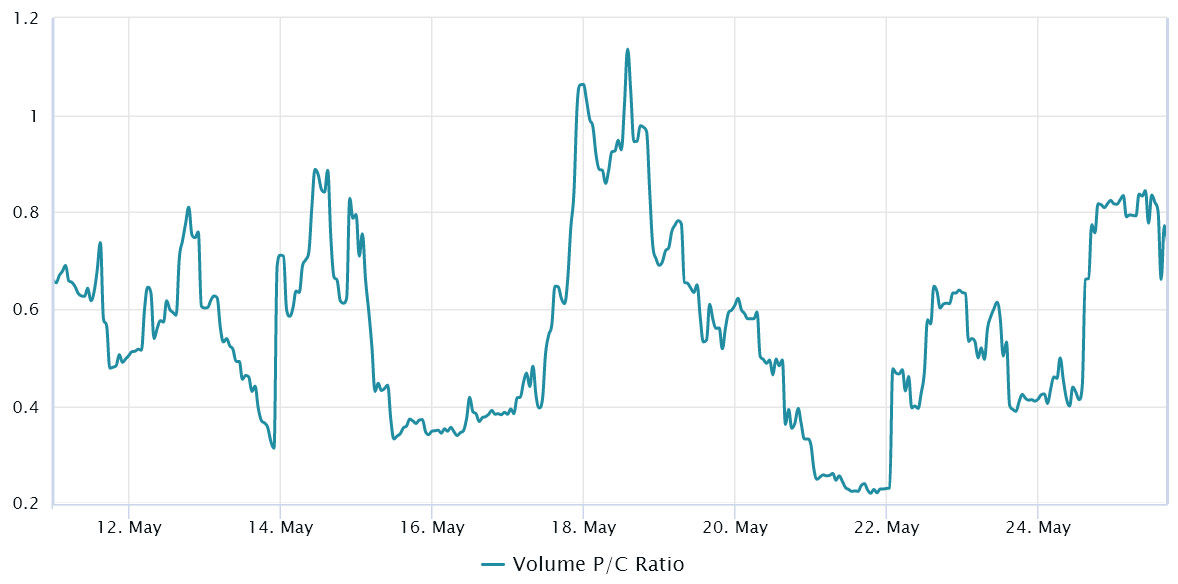

To decipher market sentiment, it is crucial to examine the prevalence of call (buy) options versus put (sell) options. A put-to-call ratio of 0.70 suggests a bullish inclination, as put option open interest lags behind more optimistic calls. Conversely, a ratio of 1.40 leans towards put options, indicative of a bearish sentiment.

In recent weeks, Bitcoin’s options volume has consistently maintained a put-to-call ratio below 1.0, signaling a preference for neutral-to-bullish call options. Interestingly, even during Bitcoin’s brief descent to $25,900 on May 25, there was no significant surge in demand for protective put options.

Given the cautious equilibrium observed in futures markets and the prevailing uncertainty surrounding the U.S. debt standoff, traders remain hesitant to take decisive actions. The crypto market’s ability to break free from the constricting grip of the descending wedge formation remains uncertain.

While professional traders may not be relying on derivatives to anticipate a catastrophic scenario for Bitcoin’s price, the absence of catalysts for a bull run within the current macroeconomic landscape suggests that bears have assumed control. As the descending wedge continues to tighten its hold, the possibility of a looming 10% correction until July cannot be ignored.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice or a recommendation to invest. Each investment decision should be based on individual research and evaluation of the specific circumstances. The cryptocurrency market is highly volatile and carries inherent risks. Past performance is not indicative of future results. The author and the publisher of this article do not assume any responsibility for any losses or damages incurred as a result of reliance on the information provided herein. It is advisable to consult with a professional financial advisor before making any investment decisions.

See also