I don’t think that this bearish market was a big surprise, but the big question is for how long? To be frank, I don’t have such an answer – it might last 1 month or even one year – there is no silly graph that can tell you the future, and don’t believe anyone who says otherwise. That being said, now is a good time to prepare for the next bull run. In this summary, I decided to explain my further steps – what I am planning to buy and when. If you are too lazy to read the whole thing, I recommend you to jump to the “summary” page, which is at the end of this article, and see the table.

BITCOIN ANALYSIS

The beginning of the bear market was signaled by the formation of the “Head and Shoulders” pattern, which forms on the top of a bullish market and indicates the beginning of the reverse trend. Soon enough we went as low as $31000. For the past couple of weeks, we tested the 30-31k support levels at least 9 times.

So far, the technical analysis points to a high likelihood of Bitcoin moving down to $25,000, as the price is moving within the “Descending triangle pattern” which basically says that the current trend (bearish) will continue.

Our next support line is between $18,000-20,000, however, we are unlikely to move that low in the nearest month. There is a high chance that Bitcoin will continue to move down till it will reach $25,000.

What about the On-chain analysis?

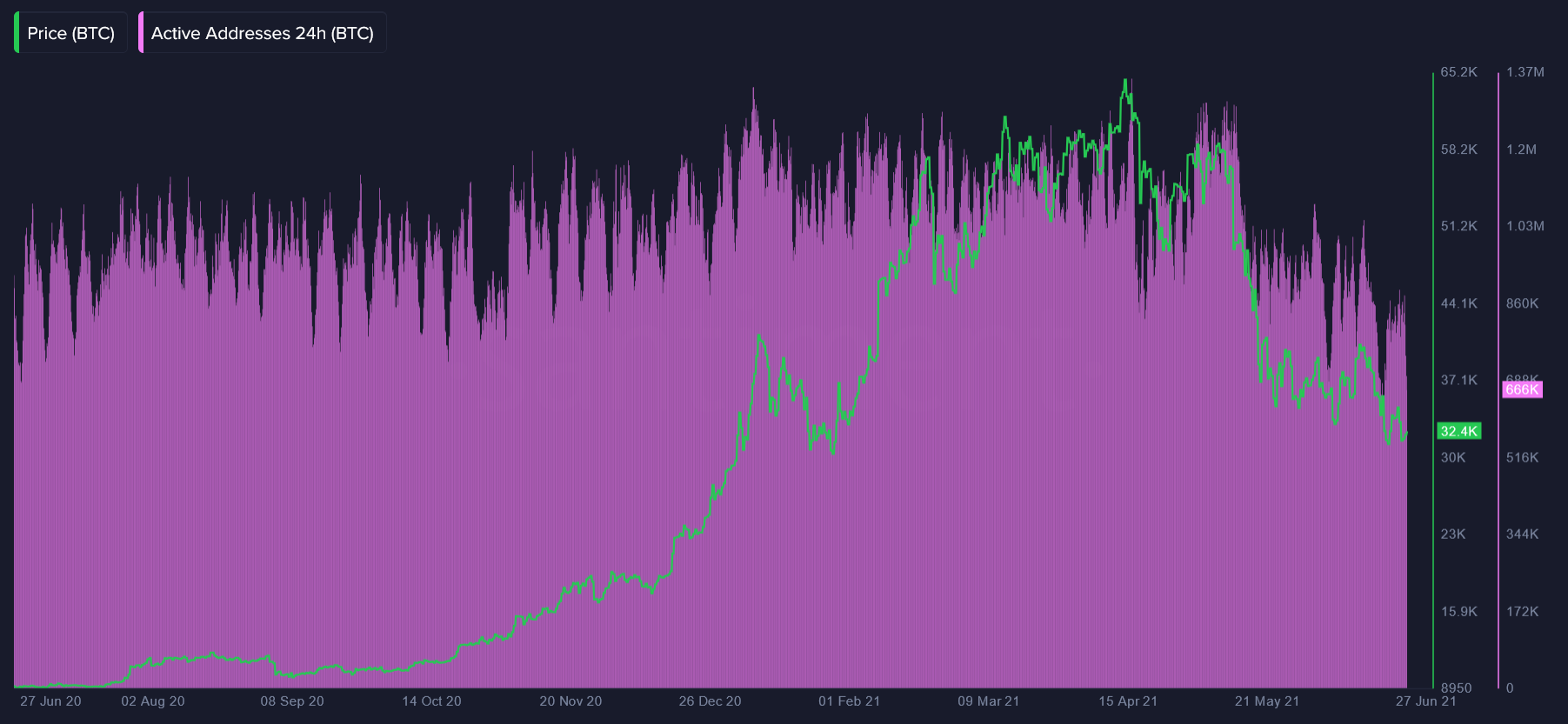

Since May 2021, the number of bitcoin’s daily active addresses has dropped by -47.6%, indicating decreasing on-chain activity – another bearish indicator. The continuous decline might suggest a lack of fundamental support and interest in Bitcoin-based services.

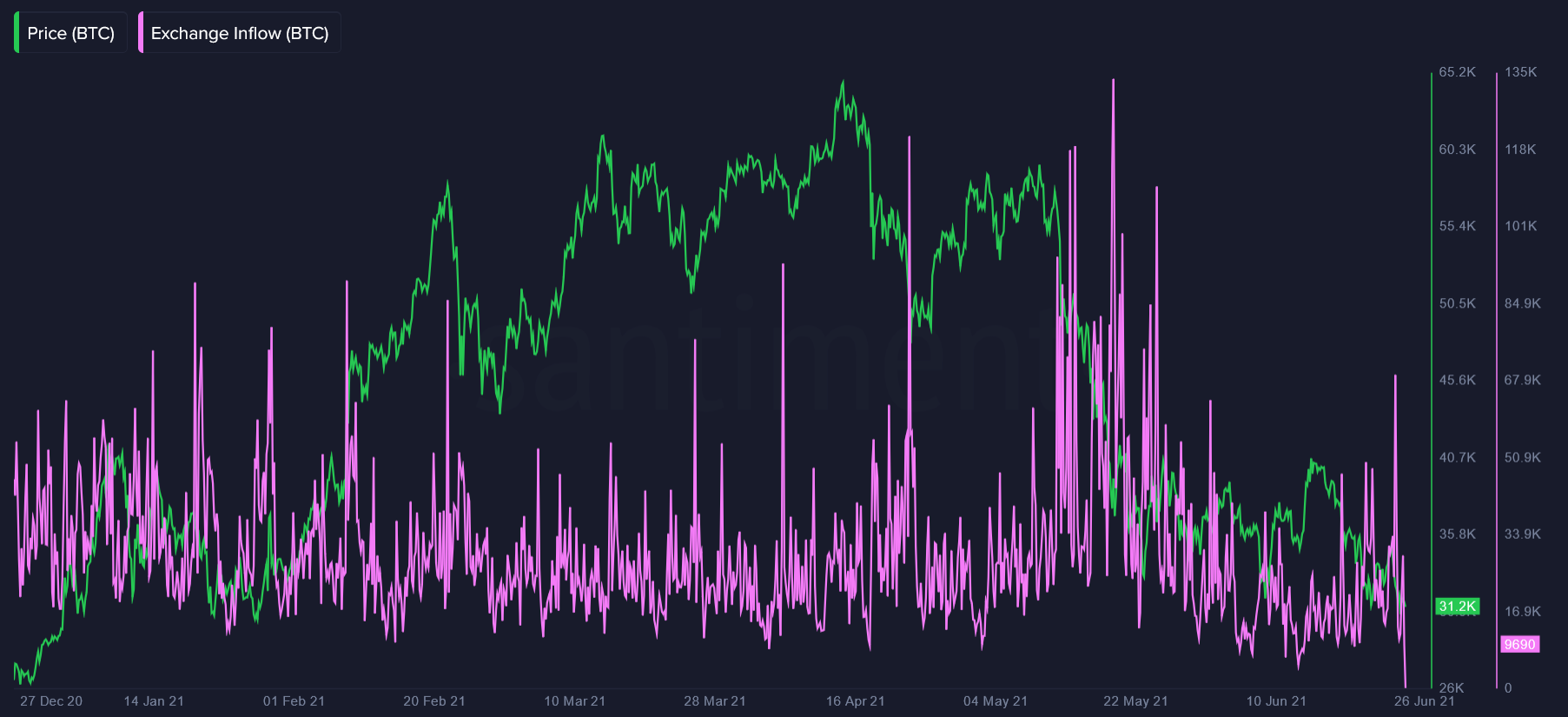

EXCHANGE INFLOW

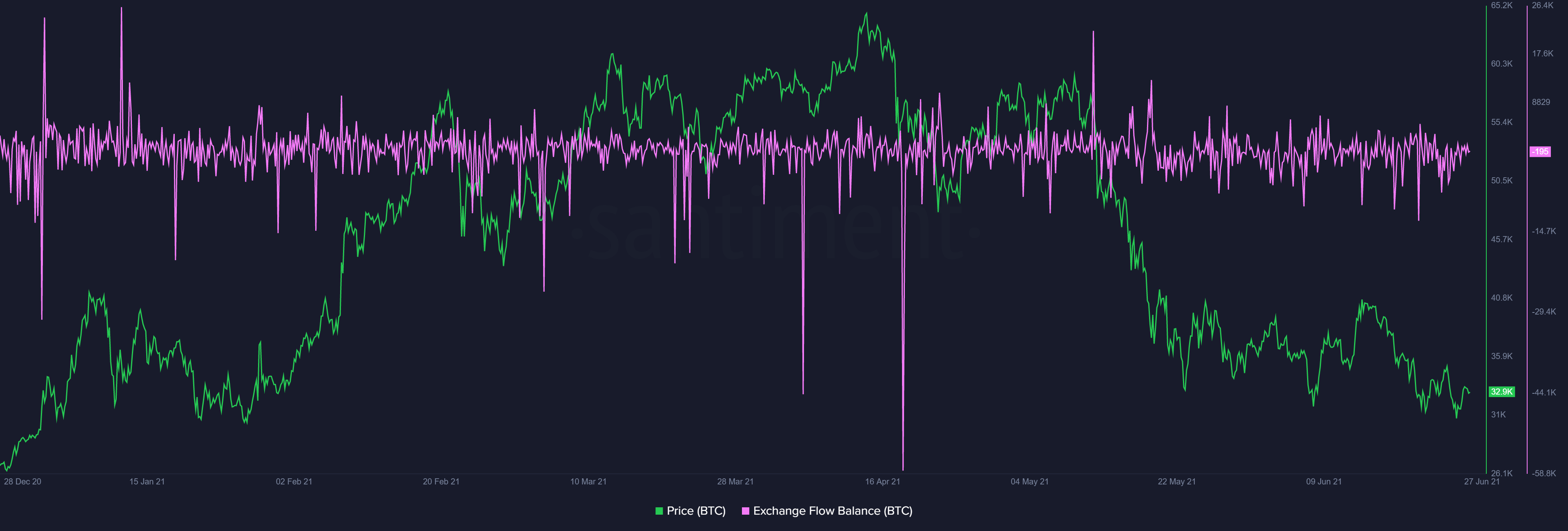

Exchange inflow is a good way to measure selling activity. When people abruptly move their BTC to exchanges, as the rule that signals growing selling pressure. Since May, we experienced massive “selling waves” and to this day we still observe occasional spikes. While the inflow volume significantly dropped in comparison with mid-May, the overall trend remains bearish, and this can be confirmed by the Exchange flow balance:

While we can’t discover any strong “Sell” signals, the absence of bullish signs during a bear market means the slow but steady continuation of a current(bearish) trend.

So, what will I do next?

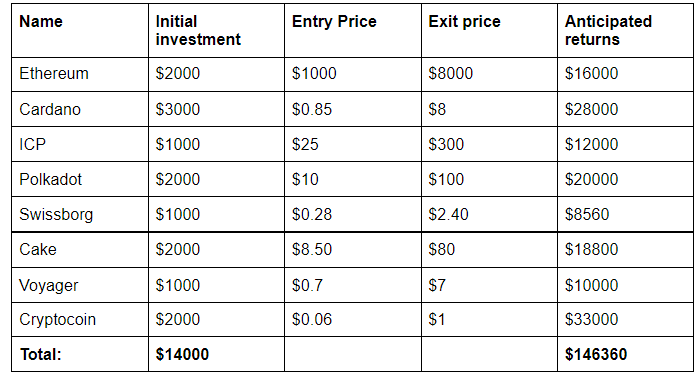

The answer is quite simple: I allocated approximately $14000 for this dip, and I decided to buy some tokens that I anticipate will make about x8 returns on average.

I will explain my rationale behind purchases and good entry prices. Most of these tokens are what I call “safe bets”. Why? Most of you have been following this channel for more than a year and you know that almost all my tokens which I picked made at least x5, and none of them failed. While it’s true that I might have missed “x100” tokens this bull run, some of my recommendations like Cardano at 9-12 cents turned out to be great. I would stick to my investment strategy which allows accumulating enough capital to outperform any other asset like stocks or Real Estate.

ADA – Cardano. I don’t need to introduce this platform as you know that I have been supporting Cardano for a long time and wrote enough about it. For the past year, Cardano made a huge leap forward, and finally, it opened up for smart contracts and dApp deployment. Since June 12th, Cardano can run smart contracts under Alonzo (Era name). I definitely anticipate Cardano to attract a plethora of developers and exchanges due to platform superiority in comparison with other platforms like Ethereum, at least until Ethereum 2.0 is rolled out. So what would be a great entry price? Anything sub $1 is a good entry price. I am planning to invest about $3000 into ADA under $1, buying approximately 3300 – 3500 tokens. My sales goal would be around $5, which would equal $15,000. However, if the next Bull cycle will be aggressive and rapidly growing, I might shift my exit point to $8 or $26400 in total.

ICP – Internet Computer. You probably have seen this token suddenly appear among the top-10 tokens about a month ago. If you still don’t know

It’s blockchain-based cloud computing that aims to form the basis of the next-generation decentralized internet. The ICP project is developed by Dfinity, which was founded in Palo Alto, California. The Dfinity Foundation is based in Zug, Switzerland, while its research center is still located in California.

The current internet runs on IP or internet protocol, however, Dfinity is introducing a new standard they call ICP, or Internet Computer Protocol. The new ICP system will allow developers to move not only data across the internet but actual software platforms as well. In practice, it means apps can be created and released that are neither owned nor controlled by anyone. The independent data centers that run the Dfinity network will be compensated in tokens for running the code on their servers, however, they won’t have access to any of the data, making it impossible for them to collect and sell data to third parties like advertisers

I don’t think that project can fully take off in the following 5-10 years, but in my opinion, it’s a tolerable gamble and it might take off.

When the token was released in public, its original price reached ~$600. While I do not think that we will get back to $600 any time soon, we might see the project reaching the $250-400 price range in the following years.

Considering that the project is quite risky and requires massive adoption for work, I will risk only 1000 USD. My entry price would be below $25. Exit target is $300 – or x12 returns, hence I should get around 12000 USD at the exit

Polkadot

Probably everyone heard about it. Nevertheless, I will briefly go over it – Polkadot is its own multi-chain blockchain that competes with other chains such as Ethereum, ATOM, Cardano, and EOS. In a way, Polkadot will be quite similar to Ethereum 2.0. To begin, Polkadot is designed to operate two types of blockchains. The main network is called a relay chain, where transactions are permanent, and user-created networks are called parachains.

Polkadot got impressive funding as it has raised roughly $200 million from investors across two sales of its DOT cryptocurrency, making it one of the most well-funded blockchain projects in history. Besides impressive funding, Polkadot is developed by the Web3 Foundation and Parity Technologies, whose co-founders are Gavin Wood (also co-Founder of Ethereum) and Jutta Steiner.

This token is likely to stay within the next top-5 tokens during the next bull run. So what’s the good entry price?

In my opinion, anything at $10 and below is a good entry for Polkatod. The goal for sale: $100. Long-term: $500 (or x50 from $10 purchase, but that’s for 3-8 years). I will allocate approximately $2000. Anticipated returns: $20000

SwissBorg

SwissBorg is a blockchain-based wealth management platform that provides its users with the infrastructure and tools to manage their cryptocurrency investments through mobile applications.

SwissBorg project dates all way back to 2017. The token was released in 2018 and its price stayed below 5 cents all the way until mid-2020. The project gained popularity in 2020 and 2021 due to its service delivery – mainly for one of the market-highest APY’s and the ability to sell and buy crypto using 15 fiat currencies. They offer anywhere between 5% to 15 percent annual yield, depending on the asset. Personally, I didn’t use Swissborg because it has restrictions for US residents, but some of my friends use its services and have mostly positive feedback about it.

Entry and Exit: I think that a good entry spot is under 28 cents, and an exit spot – $2.4

I plan to invest $1000 at $0.28 which should give me approximately 3570 tokens. The sale of the token at $2.40 will result in ~$8560

Pancakeswap – is the largest DEX and automated market maker on BSC (Binance Smart Chain). You can think about it as “Binance’s Uniswap”. It runs permissionless liquidity pools that are automated and run completely by algorithms. This use of algorithms to run the pools makes PancakeSwap an automated market maker.

PancakeSwap, like many DEXs, has its own native token called CAKE. Users can stake CAKE or use it in the SYRUP pools of PancakeSwap to earn more CAKE tokens – right now, on average you can make about 100% APY in those pools. In 2021, its price peaked at $43 and currently is traded at around $13

Entry and Exit points: In my opinion, $8-$9 is a good entry point. I plan to allocate about $2000 and exit around $80, averaging x8 – x10 returns.

Voyager

The Voyager crypto trading app is like a Swiss army knife – it includes everything in it and remains one of the most popular crypto wallets out there. While it doesn’t offer really something unique or some out-of-space technology, it definitely does a good job in its niche. As a result, it operates since 2017 and formed a stable and steadily growing customer base. What I really like about this token is that it has unbelievable price distribution over time – it can go as low as 3-4 cents and then pump to 7 dollars. This is quite a risky venture, hence I might get some voyager if its price will move somewhere below 60-70 cents. That would allow me to buy around 1600 tokens for $1000, and in case of x10 growth, sell for $7 and get back $11000

Cryptocoin (CRY) – The largest provider of crypto debit cards. Their visa-issued cards can be used worldwide and CRY tokens are required to be locked on the card for various bonuses such as cashback, APR, free Amazon Prime, and Netflix subscriptions. Personally, I own one of these cards and this project is one of those rare blockchain projects which is used by thousands of people worldwide.

Good entry price: 6 cents and below. Sell target: 1 USD. Amount: $2000

You might have noticed that my price anticipation is quite high – 1 USD. The reason is that I plan to hold this token for maybe 3-5 years while enjoying the additional APR that I get from it.

ETHEREUM

No doubts that Ethereum will keep its leadership in smart-contract blockchains for the next 2-3 years. While it’s still very slow when it comes to Ethereum 2.0 delivery, we have seen significant progress in 2021 and we are likely to see even more delivery in 2022 and 2023.

Good entry point: anything below $1200 is a good, solid buy. Ethereum is likely to peak somewhere around 8 to 10k, hence it can easily provide x6-x9 returns.

Entry and Exit: Entry at ~1000, Exit: $8000. Investment: $2000 (around 2 ETH), anticipated return: $16000

HONORABLE MENTIONS:

While I do not have plans to buy those tokens with the $14,000 I will buy them with additional cash if the prices will continue to drop significantly

BNB (Binance Token) – under $60

Uniswap – under $10

Solana- under $8

Swipe – $55 cents

Monero – under $70

STOCK MARKET

Stock market – I recently purchased 206 shares of a company called 23 and Me.

In my opinion, this stock is grossly undervalued and I will explain why.

I personally used their product when I purchased both medical and ancestry genetic tests in 2014, and now I have a full breakdown of my genetic predisposition for behavior, diseases, diet, etc. So far, this is the only leading company that gives its services worldwide and it was founded by the Google founder’s ex-wife Anne Wojcicki.

At this moment the company’s market capitalization is only 800 million USD. In comparison, AMC’s capitalization is 30 billion USD, while Tesla’s capitalization is 600 billion USD.

While I don’t think that it will grow just as quickly as cryptocurrency and give x10 in one bull cycle, I do not doubt that this company can grow at least 15-30 times in its valuation and possibly even x50 within the following 5 to 10 years.

What’s interesting is that they use genetic data (without being tied to specific customers) in genetic researches, which they then sell to medical companies, generating significant revenue. In my personal opinion, genetic-based medical treatment, research, and behavior correction will be among the most used technologies worldwide, hence I decided to invest some funds into it. Considering that 23 and Me has the world largest genetic database and the most diverse data from around the world, it makes them the most attractive research data provider for medical and pharmaceutical corporations

In case of a market dip, I plan to purchase 200 more shares if the price will reach the $10-11 dollar range.

Summary table:

P.S. This is not investment advice. This simply the journey of our very own analytical mastermind Vlad Antonov.

See also